Proven Methods That Actually Work

We've spent years developing practical teaching approaches that help people master short-term budgeting without the usual overwhelm. Here's how we make financial education stick.

View Our ProgramsThe Reality-First Framework

Most budgeting advice feels disconnected from real life. We start with your actual spending patterns, not theoretical perfect scenarios.

Our approach begins with tracking what you're already doing for just one week. No judgment, no pressure to change anything yet. Just honest numbers.

From there, we build small, sustainable changes that work with your lifestyle rather than against it. Students typically see improvements within their first month because we're not asking them to transform overnight.

This method emerged from working with hundreds of Australians who tried traditional budgeting apps and gave up. We learned that guilt-based approaches don't create lasting change.

How Learning Unfolds

Week 1-2: Current Reality Assessment

We start by understanding your existing money patterns without any pressure to change them. Students track spending using whatever method feels comfortable – apps, notebooks, or simple phone notes. The goal is awareness, not perfection.

Week 3-4: Pattern Recognition

Together, we identify spending triggers and timing patterns. Maybe you overspend when stressed, or your grocery budget explodes on Sundays. These insights become the foundation for sustainable changes rather than generic advice.

Week 5-8: Gradual System Building

We introduce one new habit at a time. Perhaps it's checking account balances every Tuesday, or setting aside money for irregular expenses. Each change builds on what's already working in your life.

Week 9-12: Refinement and Confidence

By now, students have a personalized system that fits their actual life. We spend time troubleshooting challenges and building confidence for handling unexpected expenses or income changes.

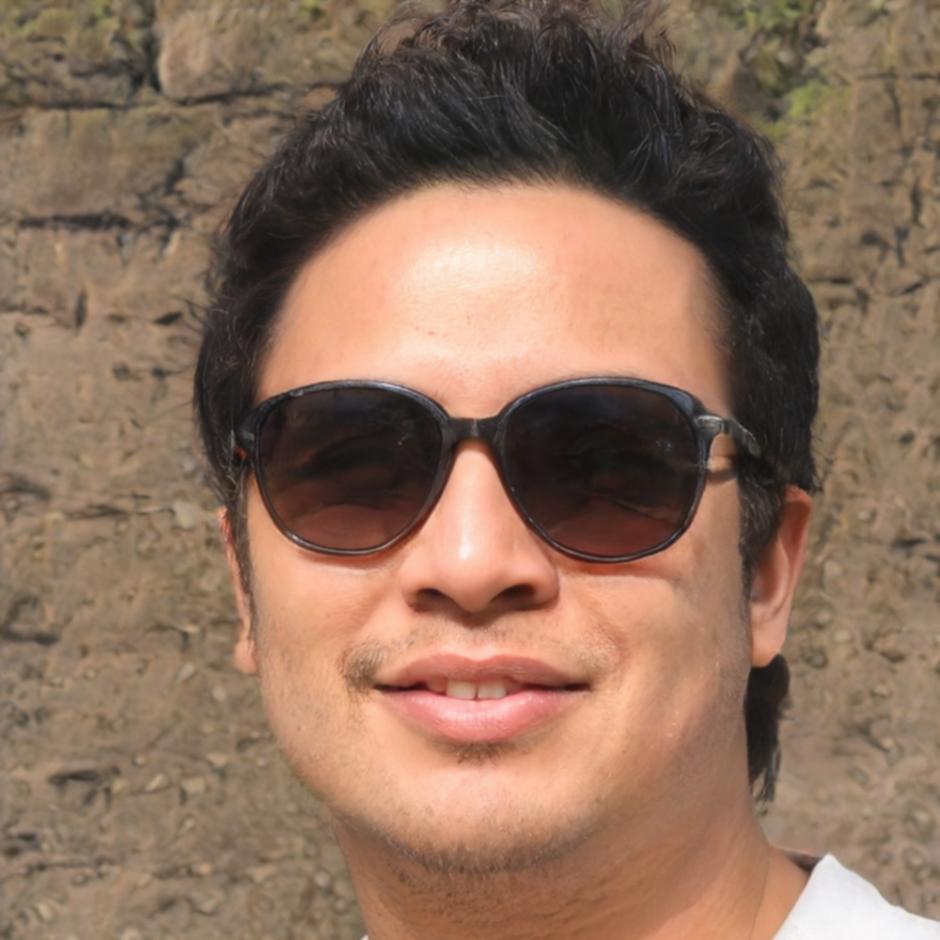

Meet Kieran Blackwood

Kieran developed our core methodology after noticing that traditional budgeting advice wasn't working for most people. His background in behavioral psychology helps explain why willpower-based approaches typically fail within a few weeks.

Before joining plexivon, he worked with community financial counseling services across Western Australia, where he saw firsthand how standard budgeting templates often made people feel worse about their money management.

His teaching style focuses on practical problem-solving rather than financial theory. Students appreciate his straightforward approach and real-world examples drawn from years of helping people navigate financial challenges.

Professional Background:

- Graduate Diploma in Financial Planning, Kaplan Professional

- Certified Personal Finance Counselor (CPFC)

- 8 years with WA financial counseling services

- Guest lecturer at Curtin University's finance program

What Makes Our Approach Different

No Shame, No Blame

We skip the moral lectures about spending habits. Instead, we focus on understanding why you make certain financial choices and how to work with your natural tendencies.

Flexible by Design

Our methods adapt to irregular income, shift work, and changing circumstances. We know life isn't predictable, so your budget system shouldn't be rigid either.

Small Wins First

Rather than overhauling everything at once, we help you achieve quick, confidence-building victories that motivate you to tackle bigger financial challenges.

Ready to Try a Better Way?

Our next program starts in August 2025. We keep class sizes small to ensure everyone gets individual attention and practical feedback on their specific situation.